One of the biggest challenges in competitive intelligence is ensuring your findings are verifiable.

In competitive intelligence we do not have the option, as with marketing research, where a large sample of respondents ensures you a high level of accuracy.

Because you are targeting a small group of highly informed respondents, you would be very lucky to complete 20 to 30 competitive intelligence surveys, versus the hundreds you can in market research.

Terms such as “corroboration” and “triangulation” are bantered around in competitive intelligence as ways to ensure the results are accurate and verifiable. But what lacks are actual examples to follow.

With this in mind, let me share you some easy to follow steps to verify your findings. Let’s assume you work for a bank that is planning to introduce robo advisory services (i.e. use highly specialized software to help customers decide what type of investments they should be making and then through a series of algorithms, distribute their money across various investments).

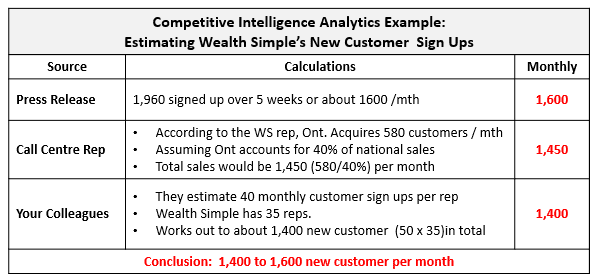

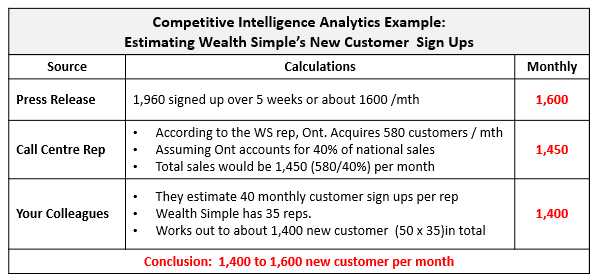

As the New Products Marketing Manager, you need to estimate the number of customers each of the major Robo Advisory providers (BMO SmartFolio, Questrade and Wealthsimple) is signing up each month.

You start with Wealth Simple and obtain monthly volumes from 3 sources (a Wealth Simple press release, the Wealth Simple call centre and your work colleagues).

You then use the highest and lowest numbers for approximating Wealth Simple’s monthly volume.

The table above spells out the steps. I hope you find them easy to follow.

Bottom line – The backbone to competitive intelligence analysis is creative, yet basic analytics to generate verifiable results.