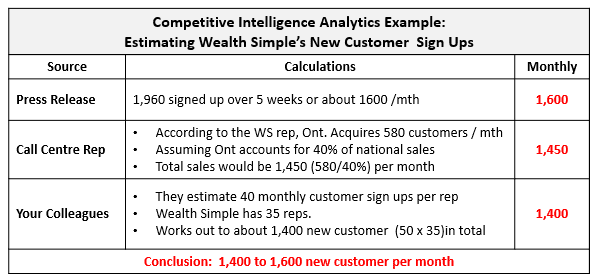

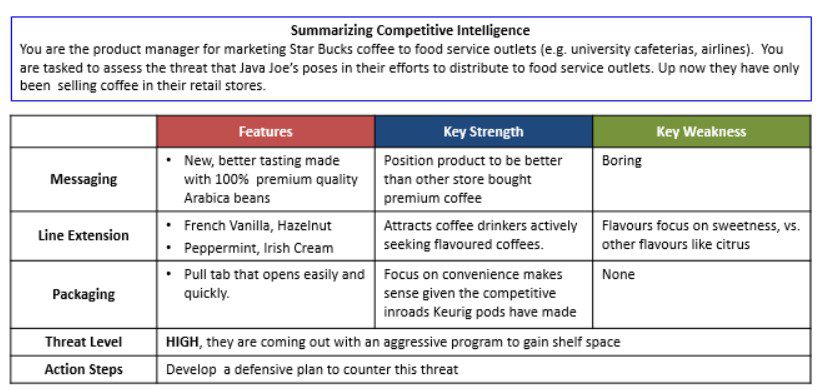

Introduction Sometimes marketing departments under pressure to learn about competitive threats, will request that their field staff gather CI without giving any direction. Whether they don’t want to risk turning off team members by imposing too many “rules” or are simply too busy juggling priorities, the outcome will be disappointing. I these situations, CI invariably becomes the flavour of the month versus providing ongoing strategic value. Factors Driving Failure Factors (and consequences) that sabotage what otherwise would be an effective communication process are: Data not is verified, resulting in incomplete, unclear and inaccurate findings. Data dumping occurs, making reading painfully time consuming and boring. Duplication of information creates the impression… Read More

Continue Reading